Read all about it

If it’s in the news and it relates to our services, clients and latest trends in Financial Planning, you’ll find it here.

Our experts are certainly not short of opinions and are always happy to share any new insights they have on all matters to do with your future financial wellbeing.

If you’d like to know more about any of the issues highlighted in these articles, just ask.

Autumn Budget 2024

Now the dust is settling after the first Labour Budget in 14 years, we consider the headlines and how these may affect clients in the future….

Essential tips for university students

Now that you’ve packed your young adults off to University and they’ve survived the trials of Freshers’ Week, it’s important to ensure they’re prepared for other challenges University will bring – finances! The following is a handy guide designed to enable them to survive the next three or four years financially:

September 2024 - Cash Recommendations Report

In this report, we have updated our figures to set out what we believe to be the most competitive rates on the various types of personal deposit accounts available at the moment. These accounts are also protected by the Financial Services Compensation Scheme (FSCS) where if a provider fails, the FSCS will pay out an amount of £85,000 per person, or £170,000 for a joint account.

If the account is with NS&I, who is backed by HM Treasury, your full balance is protected. While the rates with NS&I are no longer market leading, this feature is still particularly useful when looking to place large sums, for example, following the sale of a property. The rates quoted may be subject to change and should be checked with the relevant provider before applying.

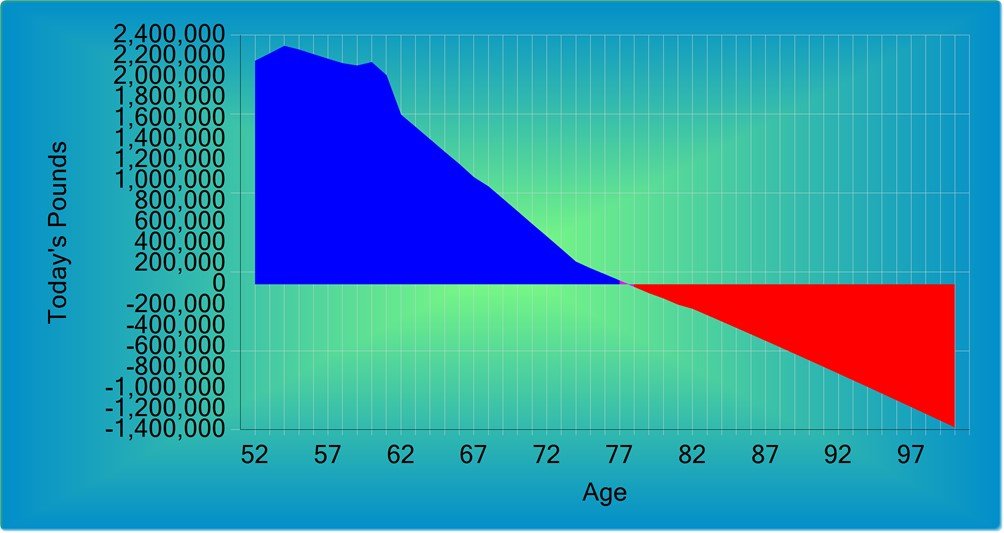

Why Cash Flow Modelling is Key to a Successful Retirement Plan

At Broadway Financial Planning (BFP), we believe that planning for retirement is one of the most critical financial decisions you will ever make. To ensure that your retirement years are as comfortable and secure as possible, it's essential to have a clear and detailed understanding of your financial future. One of the most effective tools we use to achieve this is cash flow modelling. In this article we explain why it should be a cornerstone of your retirement planning strategy

August 2024 - Cash Recommendations Report

In this report, we have updated our figures to set out what we believe to be the most competitive rates on the various types of personal deposit accounts available at the moment. These accounts are also protected by the Financial Services Compensation Scheme (FSCS) where if a provider fails, the FSCS will pay out an amount of £85,000 per person, or £170,000 for a joint account.

If the account is with NS&I, who is backed by HM Treasury, your full balance is protected. While the rates with NS&I are no longer market leading, this feature is still particularly useful when looking to place large sums, for example, following the sale of a property. The rates quoted may be subject to change and should be checked with the relevant provider before applying.

Helping your grandchildren leave university debt free

With September approaching, more than 550,000 students are expected take up places at UK universities this year. What should be an exciting new chapter in their lives can be hampered by worry of affordability.

July 2024 - Cash Recommendations Report

In this report, we have updated our figures to set out what we believe to be the most competitive rates on the various types of personal deposit accounts available at the moment. These accounts are also protected by the Financial Services Compensation Scheme (FSCS) where if a provider fails, the FSCS will pay out an amount of £85,000 per person, or £170,000 for a joint account.

If the account is with NS&I, who is backed by HM Treasury, your full balance is protected. While the rates with NS&I are no longer market leading, this feature is still particularly useful when looking to place large sums, for example, following the sale of a property. The rates quoted may be subject to change and should be checked with the relevant provider before applying.

June 2024 - Cash Recommendations Report

In this report, we have updated our figures to set out what we believe to be the most competitive rates on the various types of personal deposit accounts available at the moment. These accounts are also protected by the Financial Services Compensation Scheme (FSCS) where if a provider fails, the FSCS will pay out an amount of £85,000 per person, or £170,000 for a joint account.

If the account is with NS&I, who is backed by HM Treasury, your full balance is protected. While the rates with NS&I are no longer market leading, this feature is still particularly useful when looking to place large sums, for example, following the sale of a property. The rates quoted may be subject to change and should be checked with the relevant provider before applying.

Common investment mistakes, are you guilty of these?

Investing can seem overwhelming and complicated and so it’s easy to overlook various important elements when managing this for yourself. We thought it useful to share our top tips for avoiding the most common mistakes when investing.

May 2024 - Cash Recommendations Report

In this report, we have updated our figures to set out what we believe to be the most competitive rates on the various types of personal deposit accounts available at the moment. These accounts are also protected by the Financial Services Compensation Scheme (FSCS) where if a provider fails, the FSCS will pay out an amount of £85,000 per person, or £170,000 for a joint account.

If the account is with NS&I, who is backed by HM Treasury, your full balance is protected. While the rates with NS&I are no longer market leading, this feature is still particularly useful when looking to place large sums, for example, following the sale of a property. The rates quoted may be subject to change and should be checked with the relevant provider before applying.

What NOT to Include in Your Will: A Guide to Avoiding Common Mistakes

Creating a will is a crucial aspect of estate planning, allowing you to ensure that your assets are passed to those of your choosing when you die. However, it’s something that’s easy to overthink which can lead to unnecessary detail being included. This can then result in confusion, disputes, and even legal challenges. To ensure your wishes are carried out smoothly and to minimise stress on your loved ones at an already difficult time, here's a guide on what not to put in a will.

April 2024 - Cash Recommendations Report

In this report, we have updated our figures to set out what we believe to be the most competitive rates on the various types of personal deposit accounts available at the moment. These accounts are also protected by the Financial Services Compensation Scheme (FSCS) where if a provider fails, the FSCS will pay out an amount of £85,000 per person, or £170,000 for a joint account.

If the account is with NS&I, who is backed by HM Treasury, your full balance is protected. While the rates with NS&I are no longer market leading, this feature is still particularly useful when looking to place large sums, for example, following the sale of a property. The rates quoted may be subject to change and should be checked with the relevant provider before applying.

March 2024 - Cash Recommendations Report

In this report, we have updated our figures to set out what we believe to be the most competitive rates on the various types of personal deposit accounts available at the moment. These accounts are also protected by the Financial Services Compensation Scheme (FSCS) where if a provider fails, the FSCS will pay out an amount of £85,000 per person, or £170,000 for a joint account.

If the account is with NS&I, who is backed by HM Treasury, your full balance is protected. While the rates with NS&I are no longer market leading, this feature is still particularly useful when looking to place large sums, for example, following the sale of a property. The rates quoted may be subject to change and should be checked with the relevant provider before applying.

The State Pension - Do you know its worth?

When helping clients to plan for their future, it’s important to include all forms of income likely to used in retirement. Often, the State Pension is disregarded or forgotten. This could be as a result of those who were “contracted out” and so assumed they didn’t qualify, were not aware of when this applied or those who were under the impression it was so little it was not worth bothering about. Contrary to this, the State Pension can provide some valuable guaranteed income on which to build through careful planning.

January 2024 - Cash Recommendations Report

In this report, we have updated our figures to set out what we believe to be the most competitive rates on the various types of personal deposit accounts available at the moment. These accounts are also protected by the Financial Services Compensation Scheme (FSCS) where if a provider fails, the FSCS will pay out an amount of £85,000 per person, or £170,000 for a joint account.

If the account is with NS&I, who is backed by HM Treasury, your full balance is protected. While the rates with NS&I are no longer market leading, this feature is still particularly useful when looking to place large sums, for example, following the sale of a property. The rates quoted may be subject to change and should be checked with the relevant provider before applying.

Looking backwards and forwards

An investment roundup of 2023 from our partner, Albion, together with some thoughts for the future as we enter 2024. Despite the troubles and uncertainties in the world, there are some pretty wonderful pieces of evidence of the world's collective progress in many areas, which help act as a counterbalance to the doom and gloom that overwhelms the daily news.

December 2023 - Cash Recommendations Report

In this report, we have updated our figures to set out what we believe to be the most competitive rates on the various types of personal deposit accounts available at the moment. These accounts are also protected by the Financial Services Compensation Scheme (FSCS) where if a provider fails, the FSCS will pay out an amount of £85,000 per person, or £170,000 for a joint account.

If the account is with NS&I, who is backed by HM Treasury, your full balance is protected. While the rates with NS&I are no longer market leading, this feature is still particularly useful when looking to place large sums, for example, following the sale of a property. The rates quoted may be subject to change and should be checked with the relevant provider before applying.

November 2023 - Cash Recommendations Report

In this report, we have updated our figures to set out what we believe to be the most competitive rates on the various types of personal deposit accounts available at the moment. These accounts are also protected by the Financial Services Compensation Scheme (FSCS) where if a provider fails, the FSCS will pay out an amount of £85,000 per person, or £170,000 for a joint account.

If the account is with NS&I, who is backed by HM Treasury, your full balance is protected. While the rates with NS&I are no longer market leading, this feature is still particularly useful when looking to place large sums, for example, following the sale of a property. The rates quoted may be subject to change and should be checked with the relevant provider before applying.

As we grow older, we gain not just wrinkles and grey hair but knowledge and wisdom with the benefit of hindsight.

But if you could write a letter to yourself in the past, what would you tell yourself to do differently?

Investment impact of the unfolding tragedy in the Middle East

In light of the horrific events in Israel at the weekend and subsequent developments, we are conscious that as well as feeling huge concern and empathy for those affected, you may be concerned at the impact this may have on your investments. Our investment partner, Albion, has put together a short note highlighting the very limited direct impact the small portfolio exposure to the Israeli stock market will have. So far, other broader markets have been relatively stable. The risk of escalation exists and it is very difficult to evaluate the likely paths ahead, not least for global markets. Fortunately, the market takes all of these potential outcomes and incorporates them into today's prices. Outguessing the market is extremely challenging and, therefore, the key is to remain invested in a highly diversified portfolio.